|

Section 179 Offers Physicians Huge Tax Savings Hospitals, clinics, and physicians’ offices often incur a substantial tax liability, and finding ways to reduce taxes owed can greatly help those businesses’ bottom lines. Section 179 of the tax code gives health care facilities a powerful tool for reducing their tax burden, providing the opportunity to deduct the entirety of big-ticket medical equipment such as power tables and smaller items such as otoscopes in one year instead of depreciating it over several years.

Doctors incur a lot of costs running their practices, such as salaries and benefits, malpractice insurance, facilities maintenance, etc. While doctors’ options are limited to curb costs such as insurance premiums or facilities expenses, they can greatly reduce their tax burden by taking advantage of legal opportunities to deduct expenses from their gross income, including deductions offered by Section 179 of the tax code. Section 44 also provides a powerful tool for physicians to recoup some of the cost of upgrading their equipment, providing a tax credit for 50 percent of the cost up to $5,000 of purchasing equipment or making changes that make their practice more accessible to men and women with disabilities. Along with Section 179 deductions, Section 44 credits is a great boon to small practices and clinics. What is Section 179? Section 179 of the U.S. tax code allows businesses to deduct the full purchase price of equipment and software purchased or financed during the tax year. The equipment or software must meet eligibility requirements.

Section 179 is aimed at helping small businesses. Under Section 179, businesses can write off up to $500,000 in equipment purchases or leases. If a business purchases or leases more than $2 million in equipment, the $500,000 deduction begins to phase out dollar-for-dollar after that limit is met. Most small practices and clinics won’t hit the $2 million threshold, so Section 179 deductions are ideal for helping them get quick tax relief for their equipment purchases.

This tax incentive was developed by the U.S. government to spur businesses to buy new equipment, stimulating economic activity. In the past, Section 179 was lampooned as the “Hummer Deduction” because it allowed businesses to write-off vehicle purchases, incentivizing many business owners to purchase high-end vehicles and write off the expense. The government has since tightened up Section 179 restrictions regarding vehicle purchases. For doctors starting a new practice, a Section 179 deduction can be a huge boon because it allows them to get immediate tax relief on their equipment purchases, instead of having to spread it out over several years through depreciation. The deduction extends to equipment doctors buy, as well as equipment doctors may lease. New practices spend $50,000 to $65,000 alone on furniture, equipment, computers, etc. within their first few months, so a Section 179 deduction can be quite helpful to new practices when tax time arrives.

Here’s an example of how a medical practice might use Section 179 and bonus depreciation to lower its tax bill. Let’s say that Dr. John Smith decided in 2017 that his practice needed a new case management software program and purchased one for $20,000. Smith’s other qualifying equipment purchases for the year come to around $30,000. Rather than depreciate the equipment over several years, Smith decides that he needs to take a Section 179 deduction, now, to reduce his taxes owed when he files in 2018. Smith depreciates the software program and his other equipment expenses. Because his equipment purchases are under $500,000, he’ll be able to deduct the full amount of these purchases.

Eligible Property For taxpayers to take a Section 179 deduction on business property purchases, that property must meet requirements established by the tax code. Qualifying property includes:

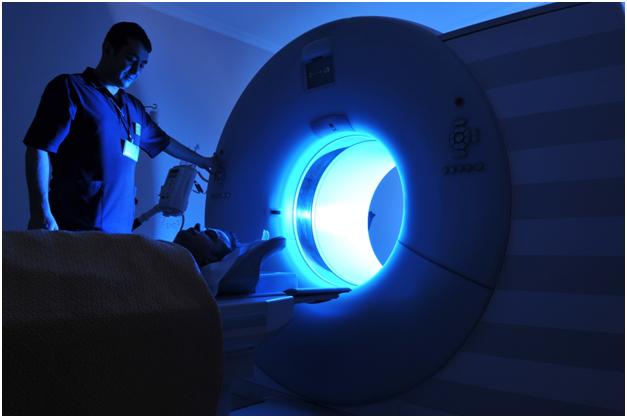

Equipment used by doctors and clinics easily qualifies under these rules. Medical equipment such as exam tables and MRI machines, and even smaller equipment such as otoscopes and colposcopes, are all deductible under Section 179. There are some important limits to Section 179 deductions of which taxpayers intending to claim them need to be made aware. The deduction is only available for equipment used more than half the time for business purposes, and the amount of the deduction will be limited to the percent of the time property is engaged for personal use. Also, Section 179 deductions may not exceed the net profit earned from a taxpayer’s business. These exceptions typically will not affect doctors or clinics, however. Property That Does Not Qualify for Section 179 Not all property qualifies for a Section 179 deduction. Much of the property that does not qualify for a Section 179 deduction would not be of interest to medical facilities, but some might. The following is a list of the types of property that do not qualify for the deduction.

Bonus Depreciation Lawmakers have given business owners another tool to use equipment purchases to lower their tax bill. In 2001, Congress created 50 percent bonus depreciation, a tax deduction that allows businesses to deduct half the cost of eligible property the first year after it is purchased and put into use. Unlike Section 179 deductions, there is no dollar limit on how much can be deducted. Bonus depreciation is not meant to be a permanent part of the tax code, but Congress has reauthorized it several times since its inception.

Bonus depreciation may only be used for new equipment (Section 179 allows deductions for used equipment), but there is no requirement that the property is used over 50 percent of the time for business. In many cases, assets purchased by doctors or clinics will qualify for both a Section 179 deduction and the 50 percent bonus depreciation. Section 44 Section 44 offers a tax credit for small businesses that make reasonable accommodations to improve access to their services and facilities for the disabled. Power tables and equipment, such as Hill Adjustable tables featuring electric power elevation, are frequently eligible for these credits. To qualify, a business must have $1 million or less in annual revenue or 30 or fewer full- time employees. The credit will reimburse businesses for 50 percent of eligible equipment purchases, up to $5,000 annually. Other Tax Deductions Section 179 deductions aren’t the only way medical facilities can reduce their tax burden. There are many other deductions medical practices can use to lower their tax bill, and many of these are often overlooked by doctors.

Doctors and other medical professionals who want to optimize their tax savings available through Section 179 and other methods should consult with a qualified tax professional. Qualified tax professionals such as CPAs can find the best legal methods for realizing tax efficiencies and avoid making deductions that may put clients in the IRS’s crosshairs for an audit.

Finding the Right Medical Equipment Company Physicians seeking a supplier for oximetry equipment and other medical gear need to find a partner that’s knowledgeable and reliable. That’s where Medical Device Depot can help. An online warehouse of thousands of medical supplies and equipment, Medical Device Depot provides brand-name products and quick fulfillment of orders for the healthcare professionals it serves. Medical Device Depot provides well-trained sales staff to help medical professionals with any questions they may have about products, and all of its new equipment comes with a long-term warranty. |