Trump Tax Plan Aids Your Bottom LineKey Section 179 Benefits Doubled for 2018Savvy medical practices will profit from the new tax rules in 2018. The Section 179 deduction limit has increased to $1,000,000 (from $500,000) and is good on new and used equipment. In addition, the spending cap on equipment purchases has increased to $2.5 million. This is the maximum amount that can be spent on equipment before the Section 179 Deduction available to your company begins to be reduced on a dollar for dollar basis. This spending cap makes Section 179 a true "small business tax incentive." And finally, the bonus depreciation is now 100% and is made retroactive to 9/27/2017. The bonus depreciation also now includes used equipment. That means that if you buy (or lease) qualifying equipment, you can deduct the FULL PURCHASE PRICE from your gross income. It's an incentive created by the U.S. government to encourage businesses to buy equipment and invest in themselves. This can make a real difference to your bottom line at the end of the year.

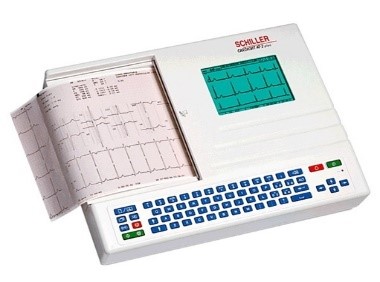

Make your office more efficient by purchasing exam tables, EKG machines, spirometers, vital signs monitors and any other medical equipment that you may need. Section 179 can provide you with significant tax relief for the 2018 tax year, but equipment and software must be financed and in place by midnight December 31, 2018. Get the equipment you need now and save on 2018 taxes. If you need financing, our partner, Ascentium Capital, has the best rates. Click here for application. For more information, please email [email protected] or call 877-646-3300. |

Call Us Mon-Fri 9-5 EDT: 877-646-3300 / 410-750-8757

We Accept Purchase Orders Above $500*

We proudly stock items from premier vendors, subject to their current inventory *

Following your order placement, be assured that we will promptly provide updates upon receiving communication from them *

Products

Products

- Deal of the Day

- Promotions

- Ambulatory BP Monitors

- Anatomical Charts & Models

- Acupuncture Charts and Models

- Blood Vessel and Nervous System Charts

- Brain Models

- Circulatory System Charts

- Dental Models

- Digestive System Charts

- Digestive System Models

- Ear Models

- Eye Models

- Genital and Pelvis Models

- Human Heart Models

- Human Skeleton Models

- Human Skull Models

- Human Spine Models

- Illness or Disease Charts

- Injection Trainers

- Lung Models

- Muscle Models

- Nervous System Models

- Organs Chart

- Pregnancy Models

- Skin Models

- Urology Models

- Body

- Head

- Foot & Leg

- Hand & Arm

- Audiometers, Tympanometers & OAE

- Bladder Scanners

- Blanket and Fluid Warmers

- Blood Pressure

- Bone Densitometers

- Breath Alcohol Testers

- Centrifuges

- Colposcopes

- Cryosurgery

- Defibrillators & AEDs

- Disposables

- Abdominal Pads

- ActiSplints

- Airways

- Ampules

- Athletic Tape

- Butterfly Wound Closure

- Cloth Surgical Tape

- Cotton Stockinette

- CPR Shield

- Disposable Scalpel

- Disposable Surgical Blades

- Ear & Ulcer Bulb Syringe

- Elastic Bandages

- Elastic Tape

- Emergency Dressings & Blankets

- Fabric Bandages

- Face Masks

- Gauze Pads

- Gauze Sponges

- Gloves

- High Risk Latex Exam Gloves-15mil

- ID Bands

- Instant Hot/Cold Packs

- Island Dressing

- Lab Coats without Pockets

- Miscellaneous Wet Pack Products

- Non-Adherent Pads

- Non-Woven Sterile Sponges

- Obstetrical Kit

- Paper Surgical Tape

- Personal Protection Products

- Porous Tape

- Povidone Products

- Retention Dressing Tape

- Sani Cloth Products

- Sheer Adhesive Bandages

- Slippers & Socks

- Sterile Eye Pad

- Sterile Iodoform Packing Strips

- Sterile Laparotomy Sponges

- Sterile Latex Surgeon's Gloves

- Sterile Packing Strips

- Surgical Tape

- Syringes

- Table Papers

- Thumb Forceps

- Tourniquets

- Towelettes

- Transparent Surgical Tape

- Triangular Bandages

- Ultrasound Gel & Transducer Covers

- Underpads

- Unna Boot Bandages

- View Guard Transparent Dressing

- Waterproof Adhesive Tape

- Wipes

- Wound Closure Strips

- Advanced Wound Care

- Bandages

- Cotton & Wood

- Health & Beauty

- Tape

- Non-Woven Dressings

- Surgical Dressings

- Gauze Dressings

- Distillers

- Dopplers

- EKG Cables and SP02 Sensors

- EKG & ECG Machines

- Electrosurgery

- Endoscopes

- Eye and Face Wash Fountains

- Feeding Pumps/IV Pumps

- Fetal Monitors

- Healthcare Refrigerators & Freezers

- Covid-19 Refrigerators & Freezers

- Pharmacy/Vaccine Refrigerators & Freezers

- Medical Refrigerators & Freezers

- NSF/ANSI 456 Certified Refrigerators & Freezers

- Scientific Refrigerators & Freezers

- General Purpose Refrigerators & Freezers

- Portable Refrigerators/Freezers

- Ultra Low Freezers

- Breast Milk Refrigerators & Freezers

- Controlled Room Temperature Cabinets

- Cryogenic Freezers

- Data Loggers

- Accessories

- Holter Systems

- Hospital Furniture

- Infection Control

- Laryngoscopes

- Medical Carts

- Accessories

- Case Carts

- Chart/Binder Carts

- Computer Carts

- Garment Rack Carts

- Hyperthermia Carts

- Luxor Carts

- Mini Carts

- Phlebotomy Carts

- Anesthesia Carts

- Emergency Carts

- Infection Prevention Carts

- Laundry Carts

- Magnetic Resonance Carts

- Medication Carts

- Orthopedic Carts

- Catheter Storage Carts

- Transport Carts

- Treatment and Procedure Carts

- Mobile Carts

- Medical Furniture

- Bassinets

- Blood Drawing Chairs

- Cabinetry

- Cribs

- Dermatology Chairs

- Equipment Rolling Stands

- ENT Chairs

- Exam Stools

- Hampers

- Headwalls

- Instrument/Mayo Stands

- IV Stands

- Kick Buckets

- Office Furniture

- Organizers

- Bar Code Scanner Holders

- Bench & Wall Organizers

- Binder Holders

- Biohazard Shields

- Blood Tube Racks

- Booty Dispensers

- Bunny Suit Holders

- Cap Dispensers

- Cell Culture Plate Organizer

- Earplug Dispensers

- Face Mask Dispensers

- Glove Box Holders

- Lock Boxes

- Microtube Rack Holders

- Neonatal Circuit Holders

- Paper Goods Dispensers

- Personal Protective Equipment (PPE) Organizers

- Pipette Holders

- Protective Eyewear Dispensers

- Respiratory Hygiene Stations

- Sundry Jars

- Suture Storage

- Wall Files

- Wipes Holders

- Overbed Tables

- Power Phlebotomy Chairs

- Phlebotomy Stands

- Privacy Screens

- Ready Exam Rooms

- Recliners

- Recliners For Dialysis

- Rollators and Transport Chairs

- Sit In Stands

- Side Chairs

- Sinks

- Sneeze Guards

- Solution Stands

- Stainless Steel Products

- Step Stools

- Stretchers

- Tables

- Waste Cans

- Wheelchairs

- Medical Lighting

- Medical Tables

- Microscopes & Loupes

- Otoscopes & Ophthalmoscopes

- Phototherapy

- Pulse Oximeters/Capnographs

- Scales/Measuring Equipment

- Spirometers

- Sterilizers/Autoclaves

- Stethoscopes

- Stress Test Systems

- Suction Equipment

- Surgical Instruments

- Arthroscopy

- Bandage/Plaster

- Biohazard Bags

- Cardiovascular

- Cleaning/Disinfecting

- Dental

- Burnishers

- Calipers

- Carvers

- Cement Spatula

- Chisels

- College Pliers

- Condensers

- Curettes

- Elevators

- Escavators

- Explorers

- Extracting Forceps

- Filling Instruments

- Forceps

- Handles

- Knives

- Mouth Gags

- Napkin Clips

- Orthodontic Pliers

- Pliers

- Pluggers

- Probes

- Rongeurs

- Rubber Dam Forceps

- Rubber Dam Punches

- Scalers

- Scissors

- Spoons

- Tongue Depressors

- Wax Placers

- Wax Spatulas

- Dermal

- Diagnostic

- Directors/Probes

- Disposables

- Drapes

- Ear

- Econo™ Floor Grade

- Econo™ Sterile

- Electrosurgery

- Equipment Covers

- Forceps

- Angiotribes

- Brain Forceps

- Catheter Forceps

- Clamps

- Dressing Forceps

- Grasping Forceps

- Hemostats

- Jeweler Forceps

- Mixter Forceps

- Mosquito Forceps

- Sklar Litegrip™ Forceps

- Sklarlite™ Forceps

- Splinter Forceps

- Sponge Forceps

- Suture Forceps

- Tenaculums

- Tissue Forceps

- Tongue Forceps

- Towel Clamps

- Tubing Forceps

- Gall Bladder/Kidney

- Genitourinary

- Hand/Plastic

- Instrument ID

- Instrument Sets

- Intestinal

- Laminectomy

- Laparoscopic Systems

- Laser Surgery

- Merit™

- Alligator Forceps

- Catheter Forceps

- Clip Appliers

- Dermal

- Directors

- Dressing Forceps

- Ear Curettes

- Ear Specula

- Ear Syringes

- Hemostats

- Mosquito Forceps

- Nasal Specula

- Needle Holders

- Neuro Hammers

- Neuro Pinwheels

- OB/GYN

- Podiatry

- Retractors

- Scalpel Handles

- Scissors

- Splinter Forceps

- Sponge Forceps

- Tissue Forceps

- Towel Clamps

- Tubing Forceps

- Merit™ Dental

- Micro-Surgery

- Mouth/Throat

- Nasal/Plastic Surgery

- Needle Holders

- Neurosurgical

- OB/GYN

- Biopsy Punches

- Cannulas

- Catheters

- Colposcopy

- Dilators

- Disposables

- Dressing Forceps

- Electrodes

- Electrosurgery

- Endocervical Curettes

- Endocervical Specula

- Endometrial Curettes

- Forceps

- Grasping Forceps

- IUD Extractors

- Needle Extenders

- Obstetrical Forceps

- Pelvimeters

- Placenta/Ovum Forceps

- Puncturing Forceps

- Retractors

- Scissors

- Sheet Holders

- Tenaculum Hooks

- Tenaculums

- Tissue Forceps

- Uterine Curettes

- Uterine Dilators

- Uterine Sounds

- Vaginal Spatulas

- Vaginal Specula

- Vulsellum Forceps

- Weighted Vaginal Specula

- Ophthalmology

- Blade Holders

- Calipers

- Cannulas

- Capsule Forceps

- Chalazion Curettes

- Chalazion Forceps

- Cilia Forceps

- Colibri Forceps

- Columella Forceps

- Corneal Forceps

- Dressing Forceps

- Eye Shields

- Eye Specula

- Fixation Forceps

- Forceps

- Foreign Body Instruments

- Hemostatic Mosquito Forceps

- Hooks

- Iris Forceps

- Jeweler Forceps

- Knives

- Lachrymal Dilators

- Lachrymal Probes

- Lens Scoops

- Loops

- Markers

- Muscle Forceps

- Needle Holders

- Ptosis Forceps

- Retractors

- Scissors

- Spatulas

- Suture Forceps

- Tissue Forceps

- Tonometers

- Tying Forceps

- Utility Forceps

- Orthodontic

- Orthopedic

- Bone Awls

- Bone Cutting Forceps

- Bone Files

- Bone Holding Forceps

- Bone Tampers

- Chisels

- Curettes

- Dissectors

- Drills

- Elevators

- Gouges

- Hooks

- Kirschner Wires

- Knives

- Lead Hands

- Mallets

- Osteotomes

- Pin Cutters

- Pliers

- Raspatories

- Retractors

- Rongeurs

- Saws

- Steinman Pins

- Tendon Retrievers

- Tendon Strippers

- Tourniquets

- Traction Bows

- Wire Extractors

- Wire Tighteners

- Pediatric

- Plasticware

- Podiatry

- Protective Apparel

- Rectal

- Retractors

- Scalpels

- Scissors

- Abdominal Scissors

- Bandage Scissors

- Crown Scissors

- Dissecting Scissors

- Iris Scissors

- Operating Scissors

- Plastic Surgery Scissors

- Sklar Edge™ TC Scissors

- Sklarcut™ Scissors

- Sklarhone™ Scissors

- Sklarlite™ Scissors

- Stitch Scissors

- Strabismus Scissors

- Tenotomy Scissors

- Thoracic Scissors

- Utility Scissors

- Sharps Containers

- SklarLite™ Containers

- Stainless Steelware

- Sterile Accessories

- Sterile Kits

- Sterile Put-Ups

- Storage Bins

- Suction Tubes

- Surgi-OR™ Mid-Grade

- Bandage Scissors

- Catheter Forceps

- Dissecting Scissors

- Dressing Forceps

- Grasping Forceps

- Hemostats

- Iris Scissors

- Mosquito Forceps

- Needle Holders

- Operating Scissors

- Splinter Forceps

- Sponge Forceps

- Stitch Scissors

- Strabismus Scissors

- Tenaculum Forceps

- Tissue Forceps

- Towel Clamps

- Tubing Forceps

- Utility Shears

- Vaginal Specula

- Wire Cutting Scissors

- Suture

- Thoracic

- Tracheal

- Trocars

- Urology

- Veterinary Surgical Instruments

- Wound Care

- Telehealth Products

- Telemetry

- Thermometers

- Ultrasonic Cleaners

- Ultrasound Machines

- Vein Viewers

- Ventilators

- Video Monitors

- Vision Screeners

- Vital Sign Monitors

- ADC Monitors

- Biolight Monitors

- Bionet Monitors

- Colin/Mediana Monitors

- Criticare Monitors

- Edan Monitors

- GE Healthcare Monitors

- Midmark Monitors

- Mindray Monitors

- Infinium Monitors

- Mortara Monitors

- Nonin Monitors

- MRI Compatible Patient Monitors

- Philips Monitors

- Riester Monitors

- Schiller Monitors

- Smith BCI Monitors

- SunTech Monitors

- Venni Monitors

- Welch Allyn Monitors

- Veterinary Monitors

- Accessories

- NDC Products

Specialty

Specialty

- Allergy Testing

- ANS Testing

- Audiology

- Balance Testing

- Bariatric

- Biomedical

- Clinical Trials

- Cognitive Measurement & Management

- Cardiopulmonary

- Ambulatory BP Monitors

- Blood Pressure

- Cardiopulmonary Exercise Testing

- Defibrillators & AEDs

- EKG Machines

- Event Monitors

- Holter Systems

- Dopplers, Vascular

- Dopplers, Vascular, Reimbursable

- Pulse Oximeters / Capnographs

- Spirometers

- Stress Test Systems

- Thermometers

- Ultrasound Machines

- Video Monitors

- Vital Signs Monitors

- Emergency Medicine

- Chiropractic

- Dental

- Dermatology & Plastic Surgery

- Dermascopes

- Surgical Instruments

- Adenoid Curettes

- Adenotomes

- Alligator Forceps

- Applicators

- Biopsy Punches

- Chisels

- Comedone Extractors

- Curettes

- Cutting Forceps

- Disposables

- Dissectors

- Dressing Forceps

- Elevators

- Gouges

- Knives

- Nail Drills

- Nasal Snares

- Nasal Specula

- Osteotomes

- Rasps

- Retractors

- Ring Cutters

- Ronguers

- Saws

- Scissors

- Septum Forceps

- Chairs

- Electrosurgery

- Microderm Abrasion

- Skin Surface Microscopes

- Ear, Nose & Throat (ENT)

- Family Practice/Internal Med.

- Ambulatory BP Monitors

- Audiometers & Tympanometers

- Blood Pressure

- Bone Densitometers

- EKG Machines

- Electrosurgery

- Cryosurgery

- Dopplers

- Laryngoscopes

- Medical Lighting

- Otoscopes & Ophthalmoscopes

- Pulse Oximeters / Capnographs

- Spirometers

- Stethoscopes

- Thermometers

- Vein Viewers

- Vision Screeners

- Vital Signs Monitors

- Jaundice Treatment

- Laboratory

- Ob/Gyn

- OB/GYN

- Hysteroscope

- Medical Tables

- Surgical Instruments

- Ambulatory BP Monitors

- Disposable Products

- Blood Pressure

- Bone Densitometers

- Colposcopes

- Cryosurgery

- Dilators

- Electrosurgery

- Fetal Dopplers

- Fetal Monitors

- Medical Lighting

- Pulse Oximeters / Capnographs

- Scales

- Specula Illumination Systems

- Sterilizers/Autoclaves

- Stethoscopes

- Thermometers

- Video Monitors

- Vital Signs Monitors

- Office Furniture

- Ophthalmology

- Pain Management

- Parts

- Phlebotomy

- Podiatry

- Rehabilitation/Physical Therapy

- Exercise Bands

- Heating Units

- Bottle Warmers

- Chilling Units

- Splint Pans

- Stand-In Tables

- Whirlpools

- Accessories

- Balance

- Chairs

- Electrotherapy

- Exercise Equipment

- Hand Therapy Tables

- Light Therapy

- Massage & Percussion

- Mat Platforms

- Mirrors

- Mobility

- Orthopedics

- Parallel Bars

- Patient Floor Lifts

- Patient Slings

- Portable Ceiling Track Lifts

- Shower/Bathing

- Sit In Stands

- Staircases

- Tables

- Traction

- Weight Storage Containers

- Weights

- Respiratory

- School Health

- Sleep Medicine

- Surgery

- Anesthesia Machines

- Blood Fluid Warmers

- Blood Pressure

- Defibrillators & AEDs

- Dopplers, Vascular, Reimbursable

- Dopplers, Perioperative

- Dopplers, Vascular

- EKG Machines

- Electrosurgery

- Laryngoscopes

- Medical Lighting

- Pulse Oximeters / Capnographs

- Sterilizers/Autoclaves

- Stretchers

- Thermometers

- Video Monitors

- Vein Viewers

- Vital Signs Monitors

- Sudomotor Testing

- Urology

- Veterinary

- Veterinary Scales

- Veterinary Anesthesia Machines

- Veterinary Blood & Chemistry Analyzers

- Veterinary Darkroom and Viewing

- Veterinary Markers

- Veterinary Paper Goods and Signage

- Veterinary Radiology

- Veterinary Sterilizers/Autoclaves

- Veterinary Models

- Veterinary Otoscopes & Ophthalmoscopes

- Veterinary Pulse Oximeters

- Veterinary Electrosurgery

- Veterinary Ultrasound Machines

- Veterinary Vital Signs Monitors

- Veterinary EKG

- Veterinary Video Monitors

- Neuropathy

Manufacturer